Highest Loan To Value Purchase Mortgages And Remortgages - Low Rate Loans From £5,000 To £150,000 - Release Your Equity With An Equity Release Plan

- Loft Conversion - A loft is often an unused area in your property and can make an ideal addition, giving you a new bedroom, office or games room. Get a free quote on finance for a loft conversion

- Building Extension - Adding a new room or extending your house can give you additional room, ideal for creating a larger kitchen or living room, home improvements loans can be an excellent way of borrowing money to extend your home

- Conservatory - Many conservatory manufacturer`s offer finance on their conservatories, but this may not always be the best option, enquire online to First Choice Finance and we will be happy to offer you a competitive free quote for your conservatory finance.

Home Improvement Loan

As well as providing finance for home extensions, our homeowner loans can be used for any home improvement / property maintenance project, decorating your home, re-wiring your electrics, simply complete our short online enquiry form and receive a no obligation free quote. As well as secured homeowner loans, we are also able to offer remortgage plans that can also be used to get money for home improvements.

As well as providing finance for home extensions, our homeowner loans can be used for any home improvement / property maintenance project, decorating your home, re-wiring your electrics, simply complete our short online enquiry form and receive a no obligation free quote. As well as secured homeowner loans, we are also able to offer remortgage plans that can also be used to get money for home improvements.New Kitchen, House Extension, Conservatory, New Windows, Redecorating, whatever home improvements you are making First Choice Finance could help you obtain the finance.

Whether it is to buy a new dream kitchen or bathroom or maybe to have a conservatory or garage built, any home improvements could add to the value of the home. First Choice Finance could help you arrange finance for your home improvements, we could arrange you to borrow £5,000 - £100,000 with a home enhancement loan.

Our range of home loans cater for a huge range of circumstances. First Choice have already helped thousands of people over the last 25 years borrow money for a variety of different reasons.

Possible reasons for an home improvement loan?

- Redecorating

- Double Glazing

- New Kitchen

- New Bathroom

- Conservatory

- New Boiler

- New Driveway

- Garden Landscaping

- Conservatory

- Building Extension

- New Garage

- Loft Conversion

- Structural Repairs

Whatever home improvements you are thinking of carrying out, big or small, we could help you arrange the finance.

Borrow £40,000, with a homeowner loan - For £40,000 you would be able to carry out extensive renovations and extensions for your home, enquire online and get a no obligation free quote on £40,000 loan or any other amount you may need to borrow.

|

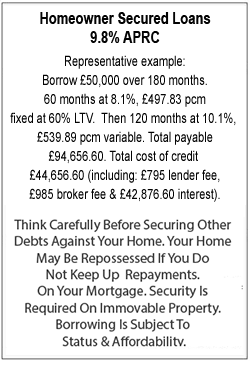

Homeowner Secured Loans |

Late repayment can cause you serious money problems. For help, go to moneyhelper.org.uk

Established In 1988. Company Registration Number 2316399. Authorised & Regulated By The Financial Conduct Authority (FCA). Firm Reference Number 302981. Mortgages & Homeowner Secured Loans Are Secured On Your Home. We Advice Upon & Arrange Mortgages & Loans. We Are Not A Lender.

First Choice Finance is a trading style of First Choice Funding Limited of 54, Wybersley Road, High Lane, Stockport, SK6 8HB. Copyright protected.

Every Quote Is Free & Confidential

Every Quote Is Free & Confidential