Highest Loan To Value Purchase Mortgages And Remortgages - Low Rate Loans From £5,000 To £150,000 - Release Your Equity With An Equity Release Plan

Payment Calculator Calculate the remortgage repayments with our remortgage calculater |  Mortgage Debt Consolidation Find out the cost for consolidating your debts into your mortgage |  Loan To Value - Mortgage What is your loan to value, use our free LTV calculator tool to determine your LTV |

When deciding whether a remortgage is right for you, you need the right information and tools at your fingertips. That`s before you have even considered all of the different remortgage plans on offer. Here at First Choice we want to make it as easy as possible for you to make the right decision and our remortgage calculator can be a vital tool in you taking a step towards the right outcome. Before you are bombarded with all of the different rates on offer, or the different mortgage types available for a remortgage you can use the calculator as a quick and easy method to calculate what your monthly mortgage payments might be.

Let our remortgage calculator crunch the numbers for you.

Remortgage Calculator Our Handy Tool

Being prepared helps you head into any situation with realistic expectations and your eyes wide open, which in our minds can never be a bad thing. We want to make sure that you guys know the financial obligations of a mortgage to make sure that together we make the right decisions for you, our customers. This is why we have developed our top of the range remortgage calculator to help you guys see the numbers plain and simple. Rather than trying to add up all of the numbers in your head, writing things down on scrap paper you simply have to input the numbers you want, for example, amount of mortgage/term/interest rate for example and it will do all of that confusing math for you and give you the numbers right back at you in black and white. It couldn`t be more simple and that`s how we want it, simple so that you can see whether you can afford the monthly repayments or whether it is the right decision for you. Our remortgage calculator is so easy it`s brilliant and just the thing to give our customers an idea of the cost of a remortgage. If that isn`t enough for you, don`t worry we have got you covered, not only do we have a remortgage calculator but we also have many other tools like our repayment calculator or our loan to value calculator. To try any of these out head over to our tab on calculators and see for yourself.

It couldn`t be more simple and that`s how we want it, simple so that you can see whether you can afford the monthly repayments or whether it is the right decision for you. Our remortgage calculator is so easy it`s brilliant and just the thing to give our customers an idea of the cost of a remortgage. If that isn`t enough for you, don`t worry we have got you covered, not only do we have a remortgage calculator but we also have many other tools like our repayment calculator or our loan to value calculator. To try any of these out head over to our tab on calculators and see for yourself.Remortgage Calculator Helps As A Budget Planner

Our remortgage calculator is great in your arsenal of tools to help you decide whether a remortgage is the right decision for you at this time or the true cost of taking one out. In fact, our calculators can help you decipher the true cost of any mortgage whether its a purchase or remortgage or even a buy to let property you are looking to take the finance out on. If you start to think creatively our remortgage calculator along with our other calculators can be used for all sorts of things, most notably as a budget planner.You can stop asking yourself can I afford this? Instead start asking yourself the more realistic question of: What can I afford? Our remortgage calculator can do just that for you. You simply put in the numbers you know you can afford with your monthly living costs and our calculator will tell you the mortgage that you might have access to (subject to lenders requirements). It is that easy. That way with a more realistic expectation you can start the ball rolling and fill in our online application form so that we can give you a call and help you along the rest of the process.

Remortgage Consolidation

There are many reasons to remortgage, be it to achieve a lower rate on your current mortgage, to raise extra funds for home improvements or to consolidate debt, among several others. Our remortgage calculator really isn`t picky it can work out the figures no matter what the reason for remortgage is.Take a debt consolidation remortgage for example, it can help you reduce your monthly outgoings and lump them into one manageable monthly payment. Use the potential benefits of a consolidation remortgage alongside our remortgage calculator and you can figure out exactly what you are paying now and how much you could be saving after a debt consolidation remortgage. At First Choice we feel that informed customers are normally the happiest which is we strive to provide you with the tools to settle on the numbers on your own terms before deciding whether a mortgage is right for you.

Other Alternatives

We understand that on occasion, after using our remortgage calculator our customers may come to the decision that at this time a remortgage isn`t what they are after. That is why we always endeavor to provide you with options, and not only that but other tools and calculators for those options too. Let us see if we might be able to help you some other way.If you were looking to raise some finance but do not want to take your current mortgage away from a great rate then an any purpose homeowner secured loan might just be what you are after? The loan can raise money for virtually any purpose and will sit behind your current mortgage. If this is something that might be of interest to you then head over to our loan calculators page to see if those numbers look more attractive or if it is a better option for you on the whole, better still give us a call on 0800 298 3000 (from a landline) or 0333 0031505 (from a mobile) and we will explain what your options are and even give you a free quote.

Been looking at too many numbers on a screen? All starting to merge into one? Don`t worry we all get that sometimes, if you have had enough of looking at the numbers on our remortgage calculator and would prefer to listen to a friendly voice down the line we will be happy to listen to your particular scenario and help you get sorted.

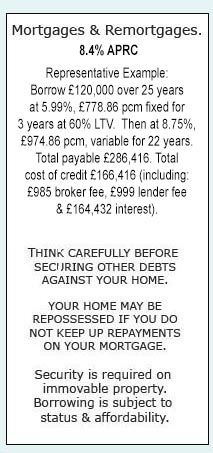

THINK CAREFULLY BEFORE SECURING OTHER DEBTS AGAINST YOUR HOME. |

Late repayment can cause you serious money problems. For help, go to moneyhelper.org.uk

Established In 1988. Company Registration Number 2316399. Authorised & Regulated By The Financial Conduct Authority (FCA). Firm Reference Number 302981. Mortgages & Homeowner Secured Loans Are Secured On Your Home. We Advice Upon & Arrange Mortgages & Loans. We Are Not A Lender.

First Choice Finance is a trading style of First Choice Funding Limited of 54, Wybersley Road, High Lane, Stockport, SK6 8HB. Copyright protected.

Every Quote Is Free & Confidential

Every Quote Is Free & Confidential