Highest Loan To Value Purchase Mortgages And Remortgages - Low Rate Loans From £5,000 To £150,000 - Release Your Equity With An Equity Release Plan

The mortgage that you are able to borrow relies primarily on getting some experienced advice and considering a number of variables, four main factors concerning mortgage affordability are shown below. You should consider;

The mortgage that you are able to borrow relies primarily on getting some experienced advice and considering a number of variables, four main factors concerning mortgage affordability are shown below. You should consider; - The amount you want to borrow in relation to the property value (commonly known as Loan To Value).

- Your current credit commitments and condition of your payment profile on any cards, loans or finance you have.

- Your total household income, include partners wherever possible and how long you have been employed.

- Finally your total current monthly outgoings that will still be in place after you take out your mortgage plus any new bills you expect to pay.

These enable your mortgage adviser and the lender to establish affordability of the new mortgage and to ascertain what rate you will qualify for.

It is important for you to consider these factors yourself too of course, so that you can be safe in the knowledge that you can afford the mortgage you are taking out. Fortunately for you, we can make help reduce the overall complexities by getting the mortgage set up and in place for you .

It is important for you to consider these factors yourself too of course, so that you can be safe in the knowledge that you can afford the mortgage you are taking out. Fortunately for you, we can make help reduce the overall complexities by getting the mortgage set up and in place for you .What Mortgage Can I Afford On My Salary?

Income is vital in determining what mortgage you can afford. Traditionally the lender uses income multiples to determine the mortgage they will lend you along with the actual outgoings you have to come out of your income. If you look at your basic salary, the average lender may lend around 4 times this, subject to various more detailed income and affordability calculations. But as a starting point If you ask yourself ` what mortgage can I afford?` A good indicator is taking your income and multiplying it by four. If for example your salary is £25,000 your could look to being able to access a £100,000 mortgage on your own. Couples multiples can be slightly lower as you are utilising 2 incomes, so for an estimate you could add both of your salaries together and multiple by 3.5. As mentioned earlier your adviser will know the other lender income requirements and will work through them with you in order to give you an more accurate representation of what products you fit for. As a seasoned mortgage business we work closely with a number of lenders and know exactly where to go to get you the best income multiples for your particular circumstance. For a free quote to see how much you could raise on a mortgage enquire on line (don`t worry - we will not do a credit search from that form) or give us a call on the above numbers to speak to one of our mortgage advisers.Monthly Outgoings And Your Mortgage

Monthly outgoings are a vital component of what mortgage you might be able to afford. Fairly self explanatory a mortgage lender needs to have an idea of what you are already paying out on a monthly basis and how an added mortgage repayment might affect this. The kind of commitments that a lender will want to take a closer look at could be for example; existing credit card commitments, spending on food each month, your petrol costs if you have a car or even how much you spend on leisure activities each month. As an experienced mortgage broker we will also work closely with you to ensure that you can afford the mortgage that you are taking on, particularly if any unforeseen circumstances were to raise your mortgage payments.Mortgages For Home Movers & First Time Buyers

When looking to purchase a new property, either as a first time buyer or home mover, the mortgage isn`t the only factor that needs to be considered when deciding if you can afford it. Future utility bills, council tax and even the cost of moving house all need to be factored in. If you are safe in the knowledge that you can afford the new mortgage, you will find it far easier to run your household finances over the coming months that could otherwise be uncertain times to some degree. For more information on purchase mortgages and the costs involved head over to our page on >> getting a purchase mortgage <<.Mortgage Calculators

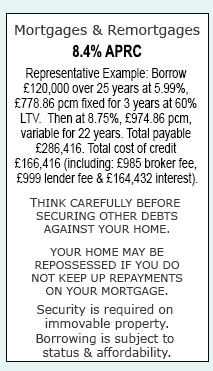

When you approach a company for a mortgage and ask the question: What mortgage can I afford? They will often crunch the numbers, taking into account the factors mentioned above, your basic salary, monthly outgoings and what LTV you are working at. Then after all of that they will churn out a value of what mortgage they are willing to lend you, providing you meet all other criteria. Whether this value is for a £100,000 mortgage or a £200,000 isn`t the most important bit. What is, is ensuring that you can honestly afford the mortgage that they are willing to lend you. We have some easy to use mortgage calculators to help you get a feel for the numbers involved. You and only you, can truly establish the amount of mortgage you are comfortable to pay. Luckily for you, we are here to help you figure that all out. Your personal mortgage adviser will carry out extensive affordability checks and help you come to a decision that you are comfortable with. After all, a mortgage is a significant financial decision and you should go into the process fully informed.Mortgages & Remortgages |

Late repayment can cause you serious money problems. For help, go to moneyhelper.org.uk

Established In 1988. Company Registration Number 2316399. Authorised & Regulated By The Financial Conduct Authority (FCA). Firm Reference Number 302981. Mortgages & Homeowner Secured Loans Are Secured On Your Home. We Advice Upon & Arrange Mortgages & Loans. We Are Not A Lender.

First Choice Finance is a trading style of First Choice Funding Limited of 54, Wybersley Road, High Lane, Stockport, SK6 8HB. Copyright protected.

Every Quote Is Free & Confidential

Every Quote Is Free & Confidential