Highest Loan To Value Purchase Mortgages And Remortgages - Low Rate Loans From £5,000 To £150,000 - Release Your Equity With An Equity Release Plan

If you want to see your guarantor loan options and get the facts and figures for your scenario simply fill in the short simple on line enquiry form and get the ball rolling with our lenders or partners. Alternatively give us a call on 0333 003 1505 (mobile friendly) or 0800 298 3000 (freephone) and we try to help.

If you want to see your guarantor loan options and get the facts and figures for your scenario simply fill in the short simple on line enquiry form and get the ball rolling with our lenders or partners. Alternatively give us a call on 0333 003 1505 (mobile friendly) or 0800 298 3000 (freephone) and we try to help.

What Is A Guarantor Loan?

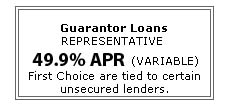

Getting a loan can be difficult for many people; if you fall into this category then a guarantor loan could be the ideal solution. Rather than the loan being based entirely on your application, a guarantor loan allows somebody else to vouch for you and in the event you cannot make the repayments on the loan, the guarantor would be held responsible to meet your payments. Representative Example: £3,500 loan repayable over 36 months. 36 monthly payments of £170.41. Variable. Representative 49.5% APR. Total amount payable is £6,134.76. This means that if you have a person who thinks you are going to be able to pay off this loan and want to help you get accepted for the finance, then provided you fit with the lender`s criteria, you can be accepted for a guarantor loan.The loan term generally is from 1 to 5 years (possibly 7 years for some larger loans) and depending on a few factors loan size is normally from £500 to £10,000 but this can vary from lender to lender. Our panel of lenders and intermediaries largest guarantor loan is £15,000. Loan purposes vary from buying a car, improving your home, paying for a wedding or special occasion, clearing a ccj or bad debt and carrying out some debt consolidation to improve your cashflow.

Whilst some more complex loans have a number of hoops that you have to jump through, a guarantor loan makes these steps clear and simple. One of the most crucial points of the lender`s criteria is that there is no credit score involved on the person applying for the loan. If you have been trying to get a loan and found that lenders are closing the door on you every time, it could be because you have bad credit or perversely enough no credit at all. Lender`s criteria for guarantor loans means that this isn`t an issue. Getting a guarantor loan approved can be more straight forward than you might think, as an established credit broker we may be able to help you find a lender that will accept you . To find out more contact the office on the above numbers.

Criteria For Guarantor Loans And What You Need

Guarantor loan lenders understand that your previous credit history doesn`t necessarily give a true reflection of your current finances. In some cases you just need a loan to get things back on track and if you have someone who understands this too, you could be well on your way to having a guarantor loan approved.You have a guarantor in place, what else do you need to get the money in your bank? Whilst the list is no where near as big as many other loan applications, most lenders criteria for guarantor loans mean there are a few things you will need:

- You will need to fit with the guarantor loan lender`s affordability. This basically means that you will need to have a regular monthly income and a certain amount of disposable income each month to make sure you can afford the loan. This is a good, common sense approach, there is no point in borrowing money that you cannot afford to pay back

- You will need to be over the age of 18 and many lender`s have a maximum age, generally 69 at the end of the term.

- You must also have a UK bank account.

Lenders Criteria For Your Guarantor

Guarantor loans are not a new concept, they are similar to the way banks used to lend, where an application for a loan was approved and based on trust. Whilst a guarantor loan can be an option for people who may have struggled with their finances in the past and want to get back on track, the lender still needs to make sure that the loan is going to be repaid. Effectively with a guarantor loan application there are two applicants involved, the person taking out the loan and the guarantor. To make sure this loan is suitable for the applicant the lender has certain lender`s criteria, not only for the applicant but also for the guarantor. Your guarantor must usually:- Be between the ages of 21 - 75.

- Be a tenant or own their own home. The loan is not secured against the property and they can still have a mortgage in place. Some lenders considering tenant guarantors for advances up to £7,000, but criteria does change from time to time - so it is always worth asking.

- Be financially stable, this may require a credit score / search to be carried out on the guarantor. They are the back up for your loan so you would expect the lender to require them to have a decent credit history.

- Be able to afford the repayments, if for any reason the loan applicant cannot do so.

The Finance Store Loans Lending Criteria

At First Choice we can provide you with access to a number of guarantor lenders to ensure that you are getting a good deal. One of the guarantor lenders that we have worked closely with and who have a comprehensive product range are TFS Loans. The lender`s criteria for TFS explains that when you are considering how long you have been in employment if you are applying for a guarantor loan, they only require you to have been working for 2 months prior to the application regardless of if you are employed or self employed. They offer larger loans that most guarantor lenders, covering the £7,000 to £15,000 loan space. They also do not require a minimum time spent at your current address for either you or your guarantor. If you fit with this lending criteria and would like to find out how much you can borrow via guarantor loans then contact the finance team on 0333 003 1505 (mobile friendly) or 0800 298 3000 (landline).Guarantor Loans |

Late repayment can cause you serious money problems. For help, go to moneyhelper.org.uk

Established In 1988. Company Registration Number 2316399. Authorised & Regulated By The Financial Conduct Authority (FCA). Firm Reference Number 302981. Mortgages & Homeowner Secured Loans Are Secured On Your Home. We Advice Upon & Arrange Mortgages & Loans. We Are Not A Lender.

First Choice Finance is a trading style of First Choice Funding Limited of 54, Wybersley Road, High Lane, Stockport, SK6 8HB. Copyright protected.

Every Quote Is Free & Confidential

Every Quote Is Free & Confidential