Highest Loan To Value Purchase Mortgages And Remortgages - Low Rate Loans From £5,000 To £150,000 - Release Your Equity With An Equity Release Plan

Twenty five years of helping you clear down your debts and get back on top of your cash flow. If you have any questions or want to talk through your circumstances don`t worry, just call us on 0800 298 3000 (landline) or 0333 0031505 (mobile) alternatively fill in our shorton line enquiry form and we will call you. The First Choice Finance debt consolidation calculator has been designed to help you get back on top of your credit commitments firstly by being able to see what the relative costs are to you for your credit cards, store cards, loans or overdraft each month. Some people have many debts made up of a number of smaller balances on the infamous plastic and it is quite easy to rack up these bills when cards are continuously offered to you. However as you add these into the debt consolidation calculator you will see that all these small payments can add up to a large monthly cost and really squeeze your budget. If there are not enough boxes just add some of your credit payments together. If you only have one or two items just leave the other ones blank.

Twenty five years of helping you clear down your debts and get back on top of your cash flow. If you have any questions or want to talk through your circumstances don`t worry, just call us on 0800 298 3000 (landline) or 0333 0031505 (mobile) alternatively fill in our shorton line enquiry form and we will call you. The First Choice Finance debt consolidation calculator has been designed to help you get back on top of your credit commitments firstly by being able to see what the relative costs are to you for your credit cards, store cards, loans or overdraft each month. Some people have many debts made up of a number of smaller balances on the infamous plastic and it is quite easy to rack up these bills when cards are continuously offered to you. However as you add these into the debt consolidation calculator you will see that all these small payments can add up to a large monthly cost and really squeeze your budget. If there are not enough boxes just add some of your credit payments together. If you only have one or two items just leave the other ones blank.Improve Your Cashflow with a Debt Consolidation Loan

Once you have filled in your credit you can then go to the second stage and have a few goes at seeing how much a loan to consolidate those credit bills into one manageable monthly payment will actually be. You can free type a number of different interest rates into the labelled box and then also try different loan terms in years underneath the loan rate. Each time you amend the interest rate box or the term box click on the calculate box again and you will be shown what your new total monthly payment would be if you use the debt consolidation loan to clear the balances on all of the credit cards, store cards, personal loans and other credit that you have listed. What you will also see is the monthly difference between the new payment for your consolidation loan and the total of your monthly payments you inserted at the beginning of the debt calculation. This monthly saving is the figure that your outgoings will go down by each month.Spreading Your Repayments vs Paying Back Interest

At First Choice Finance we want our customers to be aware of other aspects of refinancing credit through a debt consolidation loan, one thing you should always bear in mind is that by spreading your repayments over a longer term you may pay back more in interest overall, even if the interest rate on the new loan is lower than most of the credit is clearing, that still may be the case. Therefore if you are able to pay back the loan earlier then that`s all the better for you. In summary consolidation loans as a tool to get your cash flow better is a trade of between getting on top of your debts or credit bills and paying back the new loan as soon as you can to minimise the overall interest. One thing there is little doubt about if you are currently in a negative cash flow situation, that is you are spending more than you earn on a regular basis each month, then be it by a debt consolidation loan or some other means of reducing your outgoings you must aim to take action and improve your cash flow to a positive position, or matters are highly likely to get worse.Debt Consolidation Loan Companies

Debt consolidation loan companies can help you get back onto a firm financial footing, but which one offers the best deal for you? Fortunately, First Choice Finance is a specialist in consolidating debts through 25 years of experience and handling multiple client scenarios.Taking out a debt consolidation loan can be a good idea if you`ve built up high levels of unsecured debt on things like credit cards and store cards or personal loans. There`s been an increased chance of people borrowing more over the past few years as ONS figures have shown that inflation has constantly outstripped wage advances.

Not being able to pay back what you borrow can have a long-term impact on your credit rating, meaning that you may find it harder to get credit in the future, but by considering debt consolidation companies, you could go some way to repairing the damage.

A debt consolidation loan works by using the equity that`s built up in your home as collateral for a homeowner loan which which can be used to pay off all of your smaller unsecured debts and leave you with one manageable monthly repayment.

There are a number of benefits to this such as it means that you should reduce the amount you need to pay back each month and it can make your finances simpler by only needing to make a single repayment, rather than multiple at different times. Just bear in mind that your new refinancing loan will usually be over a longer period, which is likely to mean you pay more interest over the term of the agreement, so only borrow what you need and can afford.

At First Choice Finance, we can find a deal for you from our range of lenders and as debt consolidation loan company we can help ensure that repayments are as convenient for you as possible.

Discover more about how you can concentrate on paying back what you owe and be in control of your cashflow by visiting firstchoicefinance.co.uk or by calling 0333 003 1505 from a mobile or 0800 298 3000 from a landline.

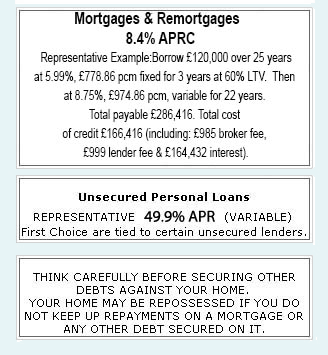

THINK CAREFULLY BEFORE SECURING OTHER DEBTS AGAINST YOUR HOME. |

Late repayment can cause you serious money problems. For help, go to moneyhelper.org.uk

Established In 1988. Company Registration Number 2316399. Authorised & Regulated By The Financial Conduct Authority (FCA). Firm Reference Number 302981. Mortgages & Homeowner Secured Loans Are Secured On Your Home. We Advice Upon & Arrange Mortgages & Loans. We Are Not A Lender.

First Choice Finance is a trading style of First Choice Funding Limited of 54, Wybersley Road, High Lane, Stockport, SK6 8HB. Copyright protected.

Every Quote Is Free & Confidential

Every Quote Is Free & Confidential