Highest Loan To Value Purchase Mortgages And Remortgages - Low Rate Loans From £5,000 To £150,000 - Release Your Equity With An Equity Release Plan

A key component of this is knowing the actual and / or proposed loan to value on your house or flat, as this will strongly influence what mortgage, remortgage or secured loan products and rates are available to you. Click to use our simple >> loan to value calculator << . With a few simple clicks of your mouse or a short no obligation, confidential phone call, we can help with your LTV calculations. First Choice Finance can provide you with all of the necessary tools to keep you informed so you are ready to get your mortgage, remortgage or home loan when you wish to go ahead. Our loan to value calculator is just one of these key tools. By using our calculator and learning your loan to value it can help you narrow down which mortgage products on the market are available to you. If you choose First Choice Finance to help you sort your mortgage, we will provide you with free quotations from our lenders and there is absolutely no obligation to proceed.

A key component of this is knowing the actual and / or proposed loan to value on your house or flat, as this will strongly influence what mortgage, remortgage or secured loan products and rates are available to you. Click to use our simple >> loan to value calculator << . With a few simple clicks of your mouse or a short no obligation, confidential phone call, we can help with your LTV calculations. First Choice Finance can provide you with all of the necessary tools to keep you informed so you are ready to get your mortgage, remortgage or home loan when you wish to go ahead. Our loan to value calculator is just one of these key tools. By using our calculator and learning your loan to value it can help you narrow down which mortgage products on the market are available to you. If you choose First Choice Finance to help you sort your mortgage, we will provide you with free quotations from our lenders and there is absolutely no obligation to proceed.What Does Loan To Value Mean?

Your loan to value, also more commonly known as your LTV is basically all about how much mortgage you have outstanding, or deposit you have ready in relation to what your property is worth. to give you a better idea of what we are referring to. If you have already inputted some numbers into the LTV calculator you will have found out that loan to value is normally calculated out of a hundred, i.e. percentage. In the case of a remortgage this figure represents the percentage of the property that is mortgaged after the replacement mortgage has been taken out. The amount of percentage that is left over is the equity that you own in the property. If you are looking for a first time buyer mortgage, the percentage that the loan to value calculator would output for you is at what LTV you need to borrow from a mortgage lender to purchase a property. The loan to value is important to both you and the lender as it tells the lenders how much of the house or flat they have a charge over, and it tells our customers how much equity they have. If you would like one of our advisers to calculate your LTV for you, give us a call on the above number, you will also be able to see what mortgages and rates are available to you at that level of LTV.

How Do I Work Out My LTV?

In this day and age we have calculators that can do all of our difficult sums for us. Our loan to value calculator can be found on the calculators tab at the top of the page along with some other calculators. They can be useful in saving time and money and it is always a good idea to be proactive and use them. Still sometimes it helps to have an idea of what mathematics those calculators are doing so you know how the answer is achieved and you can gain a better understanding of the numbers that pop out at the end.The formula for calculating your existing loan to value is as follows:

- LTV = ( current mortgage balance owed / property value at this time ) x 100 = Your Loan to Value

Some LTV Examples

Here are a few examples to give you a clearer idea of what loan to value calculations are:Existing homeowner current ltv

Property value= £200,000

Current mortgage= £150,000

LTV= 75%

Homemover

Purchase price= £400,000

Deposit from sale of property= £300,000

Mortgage required= £100,000

LTV= 25%

First time buyer

Purchase price= £100,000

Deposit saved= £10,000

Mortgage required= £90,000

LTV= 90%

These examples can give you an idea of how the loan to values play out, to get your exact value for your circumstance give us a call or enquire on line through our one minute form.

What Does My Loan To Value Mean For My Mortgage or Remortgage?

Once you have used our loan to value calculator and have established your exact LTV percentage this number becomes an integral factor when you are looking to refinance. Whether you are looking for a remortgage, a purchase mortgage, you want to take out an any purpose loan via a second charge or you just want to release some equity from your property to either improve it or refinance your credit through a refinance remortgage, your loan to value is an essential consideration for both you and the lender looking to lend you the money.This is because the higher your LTV you are borrowing more money against your security and they have less security as a result. This greater risk is reflected in the higher rates you may face if you have a higher loan to value. That being said there are plenty of lending plans that we have access to which creates competition for your business which then helps drive the rates back down again. So even if you have a high ltv, you may be surprised at just how good the mortgage rates could be. The best products available on the market are generally dedicated to those with low loan to value`s but that doesn`t mean that with the help of First Choice you cannot secure great deals for 90% purchase mortgages or even 95% first time buyer mortgages (95% mortgage using the new home schemes). Keep up to date with your LTV using our loan to value calculator so that you can get the best deals for your circumstance. Banks and multiple lenders are constantly developing new products and deals for the mortgage and remortgage market, if you fill in our online short enquiry form or give us a call on 0800 298 3000 from a landline, 0333 0031505 from a mobile.First Choice Finance can contact you with plenty of deals available to you in the current market. If they aren`t what you are looking for at this time, then maybe a second mortgage or homeowner secured loan is the answer, otherwise we can even keep you informed of any new products in the market that might be better suited to you.

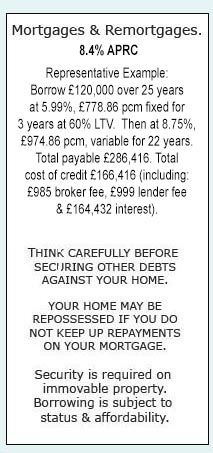

THINK CAREFULLY BEFORE SECURING OTHER DEBTS AGAINST YOUR HOME. |

Late repayment can cause you serious money problems. For help, go to moneyhelper.org.uk

Established In 1988. Company Registration Number 2316399. Authorised & Regulated By The Financial Conduct Authority (FCA). Firm Reference Number 302981. Mortgages & Homeowner Secured Loans Are Secured On Your Home. We Advice Upon & Arrange Mortgages & Loans. We Are Not A Lender.

First Choice Finance is a trading style of First Choice Funding Limited of 54, Wybersley Road, High Lane, Stockport, SK6 8HB. Copyright protected.

Every Quote Is Free & Confidential

Every Quote Is Free & Confidential