Others may want to help their loved ones or get on top of pesky credit debts, some of you may decide to do multiples of these options.

Others may want to help their loved ones or get on top of pesky credit debts, some of you may decide to do multiples of these options. If you can see that your pension income state or private, is not going to be sufficient to cover your basic lifestyle or younger outlook, then it is worth looking into other avenues to cover this shortfall. Before anything else, we would suggest researching if there are any supplementary state benefits available for your circumstance. If you can`t find a solution through the government, you might actually be able to just help yourself. It may sound too simple, but releasing equity from your home with a lifetime mortgage can afford you the necessary money to live a comfortable life, with possibly even a few memorable holidays thrown in there too. Here at First Choice Finance we have understanding equity release advisers that can talk you through your options. Simply call us on 0800 298 3000 from a landline or 0333 003 1505 if it is from a mobile phone or use our simpleon line enquiry form and we will call you.

What Is A Lifetime Mortgage?

A lifetime mortgage is essentially the same as a regular mortgage in terms of the security offered to the lender, as in it is a long term loan secured against your residential property. Only with lifetime mortgages the borrower is not required to pay back the equity loan until they move house, go into residential care or passes away. You can sometimes opt to pay the interest as theLifetime Mortgage Lending Criteria

Taking out a lifetime mortgage on your property is an important financial decision. As well as you considering the benefits and drawbacks, you will also need to be eligible. To ensure safe and prudent lending, the lenders involved with equity release have set out certain criteria that you must meet. Here are some of the main points:

Taking out a lifetime mortgage on your property is an important financial decision. As well as you considering the benefits and drawbacks, you will also need to be eligible. To ensure safe and prudent lending, the lenders involved with equity release have set out certain criteria that you must meet. Here are some of the main points:- Minimum age: Normally 55 or 60 depending on the lender.

- Your credit history will not normally impact on you being accepted, even with arrears or ccjs`s

- Minimum loan amounts: Generally varies from £10,000 to £20,000.

- Minimum property value: Ranges from £70,000 also dictated by the lender.

- The percentage of the property that you can borrow is dependent on age: The older you are the more you can borrow.

Different Types Of Lifetime Mortgages

We can provide you with access to all types of lifetime mortgages. Read on to get a feel for the three main options that may be available to you. If however, you prefer the golden days when people preferred to talk on the phone (we feel the same!) then call us on the above number or fill in the 1 minute online application form and we can call you. Our equity release advisers can help you with any questions you may have regarding a lifetime mortgage.Interest Only: The borrower is required to make the interest payments to the lender every month. The loan is only repaid when the borrower goes into care, dies or simply moves house.

Interest Roll Up: The mortgage is on an interest only basis but you do not have to make any payments to the lender. The interest that is still charged is instead rolled up into the loan. The original loan plus all accrued interest is then repaid when the borrower goes into care, moves house or dies. With this type of lifetime mortgage the debt increases over time.

Home Income Plan: A lifetime mortgage is used to purchase an annuity. The annuity then provides you a fixed income for the rest of your life. The mortgage interest rate is fixed and the annuity is then used to make interest payments to the lender each month, anything over and above that is then used to supplement your income. This method is only advisable when the annuity income is significantly more than the mortgage payments.

Lifetime Mortgage Interest Calculator

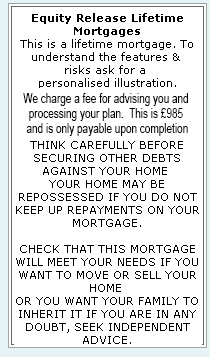

An interest only lifetime mortgage calculator can establish the maximum amount you can release from the equity in your property with a lifetime mortgage. If you would like to establish this figure for your circumstance and property, please call us on 0800 298 3000 (landline) 0333 003 1505 (mobile) If you are still exploring all of your options and would like to see how much a lifetime mortgage might cost you, head over to our remortgage calculators page and just use the interest only payment to see what the interest would be per month at different rates. Equity Release Lifetime Mortgages |

Late repayment can cause you serious money problems. For help, go to moneyhelper.org.uk

Established In 1988. Company Registration Number 2316399. Authorised & Regulated By The Financial Conduct Authority (FCA). Firm Reference Number 302981. Mortgages & Homeowner Secured Loans Are Secured On Your Home. We Advice Upon & Arrange Mortgages & Loans. We Are Not A Lender.

First Choice Finance is a trading style of First Choice Funding Limited of 54, Wybersley Road, High Lane, Stockport, SK6 8HB. Copyright protected.

Every Quote Is Free & Confidential

Every Quote Is Free & Confidential